What is the Risk Rating of Mari Invest products?

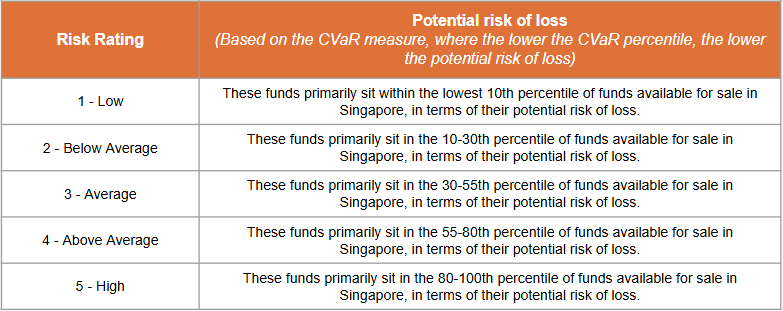

The Risk Rating classifies investment funds into 5 risk categories, ranging from 1 to 5, in order of ascending risk where 1 refers to the lowest risk and 5 refers to the highest risk.

This classification aims to help customers understand the risk levels of different funds available on Mari Invest.

You can find out the Risk Rating of a product with the following steps:

1. Log in to your MariBank app.

2. Tap Mari Invest on your homescreen.

3. Tap on Mari Invest Income.

4. Scroll down and view the Risk Rating in the Mari Invest SavePlus vs Income section.

Alternatively,

1. Tap on Me.

2. Tap on Apply for a New Product.

3. Tap on View for Mari Invest.

4. View the Risk Rating in the top right corner of each card.

The Risk Rating is sourced from the Morningstar Fund Risk Ranking provided by Morningstar Investment Adviser Singapore Pte. Limited, which is intended for general circulation and does not take into account the specific investment objectives, financial situation, or needs of any individual.

The Risk Rating is based on quantitative and qualitative assessments, and only applies to collective investment schemes (i.e. does not apply to other investment products such as stocks and bonds). Read more about the Morningstar Fund Risk Ranking here.

Please note that the Risk Rating:

· Is meant for informational purposes and should not be relied upon as financial advice;

· Cannot be used to assess the suitability of any individual investment product for you; and

· Is not static and may vary for each product over time without notice.

All investments come with risks, including the risk that you may lose all or part of your investment. You are responsible for your own investment decisions and you must read the fund's documents before making an investment decision.

Contact Us

Our 24/7 Customer Service Team is here for you if you have any questions!